Zerodha Kite vs Upstox Pro: Which Is Better?

Choosing the right trading platform is crucial for Indian investors and traders. Both Zerodha Kite and Upstox Pro are leading platforms offering robust features tailored to different trading needs. Here’s a detailed comparison to help you decide which aligns best with your trading style.

Platform Overview

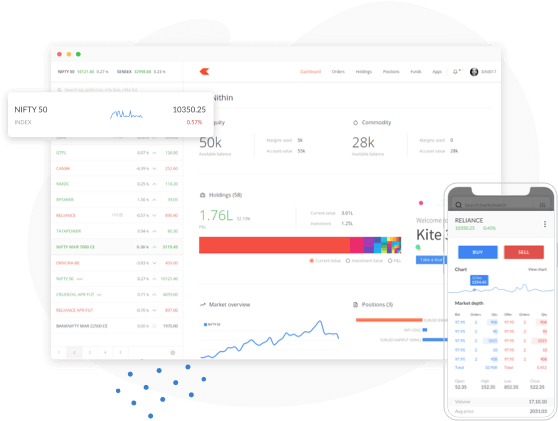

- Zerodha Kite: A web-based trading platform known for its clean interface and advanced charting tools. It supports trading across equity, derivatives, commodities, and currencies. Kite is complemented by Zerodha’s suite of products like Coin for mutual funds and Console for reporting.LinkedInZerodha+1Mojek Money+1

- Upstox Pro: A versatile trading platform offering both web and mobile applications. It provides advanced charting, real-time market data, and a range of order types. Upstox Pro caters to traders interested in equities, commodities, currencies, and derivatives.

Key Features Comparison

| Feature | Zerodha Kite | Upstox Pro |

|---|---|---|

| User Interface | Minimalistic and intuitive | Modern and customizable |

| Charting Tools | Advanced charts with multiple indicators | Interactive charts with technical analysis tools |

| Order Types | Market, Limit, Stop-loss, GTT | Market, Limit, Stop-loss, OCO |

| Mutual Fund Access | Via Zerodha Coin | Integrated within the platform |

| Educational Resources | Comprehensive through Zerodha Varsity | Basic tutorials and articles |

| API Access | Available for algorithmic trading | Available with advanced features |

| Mobile App | Kite Mobile App | Upstox Pro Mobile App |

Brokerage and Charges

- Zerodha:

- Equity Delivery: ₹0

- Equity Intraday and F&O: ₹20 or 0.03% per executed order (whichever is lower)

- Call & Trade: ₹50 per order

- AMC for Demat Account: ₹300 annuallyUpstox – Online Stock and Share Trading+6IPO Central+6LinkedIn+6Investor Gain

- Upstox:

- Equity Delivery: ₹0

- Equity Intraday and F&O: ₹20 per executed order

- Call & Trade: ₹50 per order

- AMC for Demat Account: ₹150 annually or ₹75 quarterly

Note: Charges are subject to change; please refer to the respective platforms for the latest fee structure.

Pros and Cons

Zerodha Kite

- Pros:

- User-friendly interface suitable for beginners and experienced traders

- Comprehensive educational content through Varsity

- Seamless integration with other Zerodha productsLinkedIn+1Mojek Money+1Zerodha+1LinkedIn+1

- Cons:

- Limited customization options compared to some competitors

- No 24/7 customer supportIPO Central+1Reddit+1

Upstox Pro

- Pros:

- Highly customizable interface

- Advanced charting tools with real-time data

- Competitive brokerage ratesUpstox – Online Stock and Share Trading+12LinkedIn+12Investor Gain+12

- Cons:

- Educational resources are not as extensive as Zerodha’s

- Some users report occasional app performance issuesMojek Money+3LinkedIn+3ajithprasad.com+3

Which Platform Should You Choose?

- Choose Zerodha Kite if:

- You value a straightforward, easy-to-use interface

- Access to comprehensive educational materials is important

- You prefer seamless integration with mutual fund investmentsMojek Money+4LinkedIn+4Medium+4

- Choose Upstox Pro if:

- You desire a highly customizable trading experience

- Advanced charting and analytical tools are a priority

- You seek competitive brokerage rates with a modern platformReddit+2LinkedIn+2Mojek Money+2

Conclusion

Both Zerodha Kite and Upstox Pro offer robust platforms catering to different trading needs. Your choice should align with your trading style, the importance of educational resources, and the specific features you value in a trading platform.